The world of Non-Fungible Tokens (NFTs) has taken the art, entertainment, and investment industries by storm in recent years, with sales reaching unprecedented levels. One of the most striking moments in this emerging market was the sale of a digital artwork for a jaw-dropping amount of $69 million. This sale, often referred to as the “NFT 69 million” event, has brought NFTs into the mainstream, sparking debates, excitement, and curiosity about the future of digital ownership. This article will dive deep into the high-stakes world of NFTs, exploring the key factors that have contributed to their success, the challenges and risks involved, and what the future might hold for this innovative and often controversial market.

Understanding NFTs: A New Era of Digital Ownership

NFTs, or Non-Fungible Tokens, are a type of digital asset that represent ownership or proof of authenticity of a unique item or piece of content on the blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged one-for-one, NFTs are unique and cannot be directly exchanged for one another. Each NFT is stored on a blockchain, a decentralized digital ledger that provides transparency, security, and proof of ownership.

NFTs can represent a wide range of digital and physical assets, including artwork, music, videos, virtual real estate, and even tweets. These tokens have created a new avenue for creators to monetize their work, offering them a direct connection to buyers without the need for traditional intermediaries like galleries or record labels.

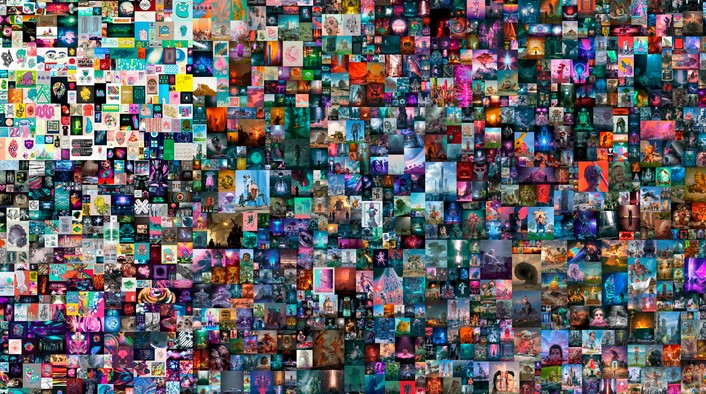

The groundbreaking sale of a digital artwork by artist Beeple for $69 million in March 2021 was a watershed moment in the NFT space. The artwork, titled Everydays: The First 5000 Days, was sold at a Christie’s auction to an anonymous bidder, setting a new record for the most expensive digital art sale at the time. This historic sale not only propelled NFTs into the mainstream but also opened the door to new possibilities for how we think about ownership and value in the digital world.

The Surge in NFT Popularity: What Drives the Demand?

Several key factors have contributed to the meteoric rise in the popularity of NFTs. One of the most significant drivers has been the increasing interest in digital art and collectibles. As the world has become more digitally connected, people are spending more time online, consuming digital media, and engaging in virtual experiences. NFTs provide a way for individuals to own, collect, and trade these digital assets, just as they would physical works of art or rare collectibles.

The ability to prove ownership through blockchain technology is another crucial factor behind the success of NFTs. In the past, digital art could easily be copied and distributed, making it difficult for artists to claim ownership or sell their work. NFTs address this issue by offering a secure, verifiable way to prove ownership, which is particularly appealing for collectors and investors looking to acquire rare or unique items.

Furthermore, the rise of cryptocurrencies, particularly Ethereum, has provided a platform for NFTs to thrive. Ethereum’s blockchain allows for the creation and transfer of NFTs, making it the dominant platform for NFT transactions. As the value of cryptocurrencies has increased, so too has the demand for NFTs, as many collectors and investors see them as a way to diversify their portfolios.

Social media and celebrity endorsements have also played a significant role in the rise of NFTs. High-profile figures such as Elon Musk, Grimes, and Snoop Dogg have publicly supported and participated in the NFT market, bringing even more attention to this digital phenomenon. Additionally, NFT platforms like OpenSea and Rarible have made it easier for creators and collectors to buy, sell, and trade NFTs, further fueling the market’s growth.

The Risks and Challenges of Investing in NFTs

While the NFT market has shown remarkable growth, it is not without its risks and challenges. One of the most significant concerns is the volatility of the market. Just like with cryptocurrencies, the value of NFTs can fluctuate wildly, with some assets seeing dramatic price increases, while others experience sharp declines. This makes it difficult to predict the long-term value of an NFT, and investors should be prepared for the possibility of significant losses.

Another challenge is the environmental impact of NFTs. Most NFTs are built on the Ethereum blockchain, which uses a proof-of-work (PoW) consensus mechanism that requires large amounts of energy to process transactions. Critics argue that the environmental cost of minting and trading NFTs is unsustainable, and this has led to calls for more eco-friendly alternatives. Ethereum is working on transitioning to a proof-of-stake (PoS) mechanism, which would significantly reduce its energy consumption, but this transition is still underway.

The NFT market is also highly speculative, with many buyers investing in digital assets based on hype rather than intrinsic value. This speculative nature can lead to bubbles, where prices are inflated and eventually crash. As the NFT market continues to evolve, it will be essential for buyers and creators to carefully assess the true value of an asset rather than relying solely on trends or celebrity endorsements.

Lastly, there are concerns about copyright infringement and fraud in the NFT space. Since anyone can create and sell an NFT, it is possible for individuals to mint tokens for works they do not own the rights to, potentially infringing on artists’ intellectual property. Additionally, there have been instances of fake NFTs being sold to unsuspecting buyers. To mitigate these risks, it is important for both buyers and sellers to conduct due diligence and verify the authenticity of NFTs before making transactions.

The Future of NFTs: What Lies Ahead?

As the NFT market continues to mature, there are several exciting possibilities for its future. One potential development is the integration of NFTs with virtual reality (VR) and augmented reality (AR) platforms. As these technologies evolve, NFTs could be used to represent virtual real estate, digital fashion, and interactive experiences, allowing users to interact with their digital assets in entirely new ways.

Another exciting area of growth is the use of NFTs in gaming. Many gaming companies are exploring the potential of NFTs to create unique in-game items, characters, and skins that players can own, trade, and sell. This could create a new economy within the gaming industry, where players can earn real-world value through their in-game activities.

Moreover, the rise of decentralized finance (DeFi) could lead to the creation of NFT-based financial products, such as fractionalized ownership or NFT-backed loans. These innovations could make NFTs more accessible to a wider audience and increase their utility beyond simple collectibles.

However, as the NFT market expands, it will be essential for regulators to establish clear guidelines to protect both creators and consumers. With the increasing number of NFT transactions, there will likely be a need for greater transparency, consumer protection, and standards for verifying the authenticity and value of digital assets.

In conclusion, the “NFT 69 million” sale was a pivotal moment in the development of the NFT market, highlighting the immense potential of digital collectibles and their ability to disrupt traditional industries. While the NFT market is still in its early stages, it has already shown that it has the power to reshape how we think about ownership, art, and investment. As the market continues to evolve, it will be fascinating to see how NFTs continue to push the boundaries of digital ownership and what role they will play in our increasingly digital future.